CPP Strategies

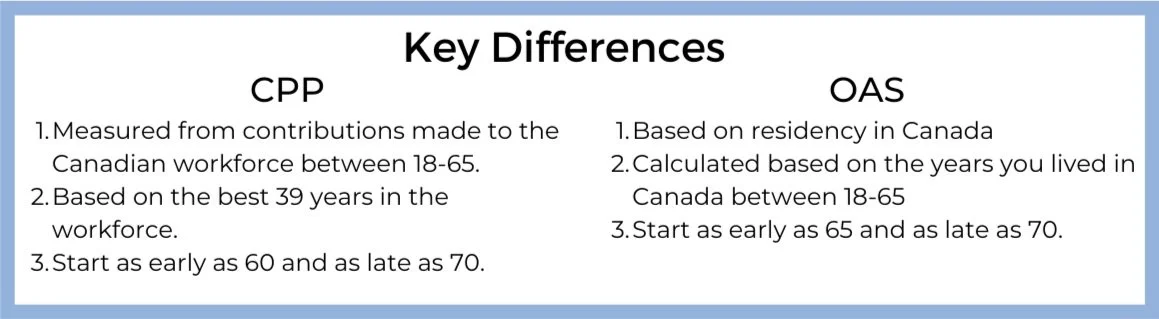

Only 1 per cent of Canadians delay their Canada Pension Plan to age 70, despite it being the most optimal strategy. It's important to know that if you take CPP at any time before age 65, there’s a penalty and reduction in income. For example, the difference between taking CPP at age 60 versus age 70 is a 122 per cent difference in the monthly benefit. To put it plainly, if you were entitled to $1000 a month at age 60, if you waited until age 70, it would be $2,220 per month.

Although best practices indicate that delaying CPP to 70 is optimal, there are times when it makes sense to take it early. If you retire before age 55 it could make sense to take CPP because of how they do their calculations. Another example is if there’s any reason to suspect a shortened life expectancy, it makes sense to collect the benefit early.

OAS Strategies

It could make sense for certain individuals to take OAS at 65 because they could be more likely to hit the clawback threshold after age 70 when other retirement income like Registered Retirement Income Fund (RRIF) minimum income comes into play.

However, the rule of thumb for OAS is the same as for CPP. In simplified terms, it’s best to delay to age 70 as there is a 0.6 per cent monthly increase in the OAS benefit which means a 7.2 per cent increase every year, and if you delay the full five years up to 70, that’s a 36 per cent increase in the monthly income that you will receive, resulting in a significant income enhancement. It’s also important to keep in mind that by delaying you will also start your inflation indexing from a higher benefit amount.

Something else to be aware of is that OAS is not a guaranteed benefit. Some people apply at age 65 while they are still working believing they are entitled to the benefit only to cancel or delay due to clawbacks. If your income is above $81,761.00 in 2022 the benefit will begin to be clawed back. In this scenario, it is a better option to start your OAS benefit once you’ve retired or turned 70 and you don’t have any more earned income.